estate tax changes for 2022

1 For tax years beginning after December 31 2022. 2022 proposed changes for real estate inheritance taxes.

Gear Up For The End Of Year With 1031 Strategy For Estate Planning Tax Straddling Pay Tax In 2021 Or 2022 Sb1079 Estate Planning Paying Taxes How To Plan

You Have Until 2022 for the Changes to Take Effect.

. This means a married couple can use the full 2412 million exemption before any federal estate tax would be owed. Revenue Procedure 2021-45 provides details about these annual adjustments. These include increased gift estate and generation-skipping transfer GST tax exemptions the unified credit annual gift tax exclusions and retirement account limits.

No Change to Portability. For 2022 the administration is proposing to increase the top income tax rate for individuals from 37 to 396 applicable to incomes over 452700 for individuals or 509300 for joint filers. Published March 28 2022.

Normally what happens when someone passes away and all the assets that person owns are above a certain dollar threshold the estate pays tax on that before it gets passed on to the heirs. We are still waiting for the drafting of the legislation to begin. However even if you have a sizeable estate to pass on to your progenitors 40 is a large chunk to give to taxes once youve reached the 5000000 threshold in 2022.

The good news on this front is that the reduction of the estate and gift tax exemption from. Gift and Estate Tax Law Changes 2022. On March 28 2022 the Biden Administration proposed a minimum tax on extremely wealthy taxpayers in its FY 2023 budget.

Twenty-one states and the District of Columbia had significant tax changes take effect on January 1 2022. In case of transfer of ownership of all kinds of. The lifetime exemption is the total.

The new law on the issuance of the certificate of non-debt of the Real Estate Tax which is necessary for real estate transfers brings significant changes with the most important being the acceleration of procedures which will give a sigh of relief to notaries and owners. The lifetime unified gift and estate tax exemption and the annual estate tax exclusion. As of January 1 2022 the federal gift and estate tax exclusion amount as well as the exemption from generation-skipping.

This is a modal window. The bad news is it will be reduced to. Estate Tax Rate Stays the Same.

The tax rate for affected wealth transfers would be 40 according to the provision summary. In 2022 the federal estate tax exemption rises to 1206 million from 117 million in 2021. 26032022 1348.

With this you can give up to 16000 to as many people as you wish without those gifts counting against your lifetime exemption which is stated below. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax while a married couple can shield 2412 million. Gift Tax Exclusion The gift tax exclusion in 2022 has increased to 16000 per individual or 32000 per married couple splitting their gifts.

In case of transfer of ownership of all kinds of real estate for any reason and before signing the. 10000000 as adjusted for chained inflation presently 11700000 per person will be intact through the end of 2021. Key Tax Concepts for 2022.

Lifetime Exclusion Increases to 12060000. These changes may impact you if you have a taxable estate. Fortunately the estate tax rate will stay the same at 40 with this new tax plan.

What you need to know about the personal income and estate tax proposals in Bidens proposed 2022 budget and tax plans News continues to come out about the Biden administrations tax proposals. The Portability Election which allows a surviving spouse to use his or her deceased spouses unused federal estate and gift tax exemption is unchanged for 2022. The new law on the issuance of the certificate of non-debt of the Real Estate Tax which is necessary for real estate transfers brings significant changes with the most important being the acceleration of procedures which will give a sigh of relief to notaries and owners.

The Internal Revenue Service IRS has released annual inflation adjustments for 2022. You have until june 15 2022 to file your return if you or. The District of Columbia was the only jurisdiction to increase income taxes.

Exemptions may return if tax laws change again but for 2022 you cannot claim a personal exemption. With 2022 set to be pretty tough on our finances its important to make sure youre clued up on the latest tax changes so you can plan ahead and avoid any fines for getting it wrong. Two key estate planning numbers will change effective January 1 2022.

Five states Arizona Arkansas Louisiana North Carolina and Oklahoma cut individual income taxes effective January 1. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. Brackets will then reset annually based on inflation.

As announced in the 2021 Autumn Budget many taxpayers will soon see higher tax bills for dividend income along with National Insurance hikes despite calls for the government to call. IR-2021-219 November 10 2021 The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other tax changes. The effect of the change would be to reduce the basic exclusion amount for estate tax purposes to 602.

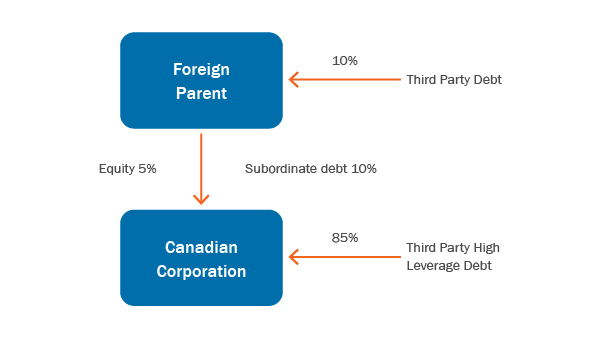

Decrease of Estate and Gift Tax Exemption. Canada Tax Law Changes 2022 Canada Tax Law Changes 2022. What does Biden want to change with regards to inheritance taxes.

The changes are as follows. Proposed Changes to Tax Law Affecting Wealthy Individuals in 2022. The new law on the issuance of the certificate of non-debt of the Real Estate Tax which is necessary for real estate transfers brings significant changes with the most important being the acceleration of procedures which will give a sigh of relief to notaries and owners.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for.

80 Tax Preparation Infographics Instagram Tax Preparation Tips Tax Prep Services Tax Prep Tax Preparation Instagram Finance In 2022

Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets

Buy The Telegraph Tax Guide 2021 45th Edition By Joe Mcgrath Hardcover In United States Cartnear Com In 2022 Tax Guide Inheritance Tax Tax Return

State Corporate Income Tax Rates And Brackets Tax Foundation

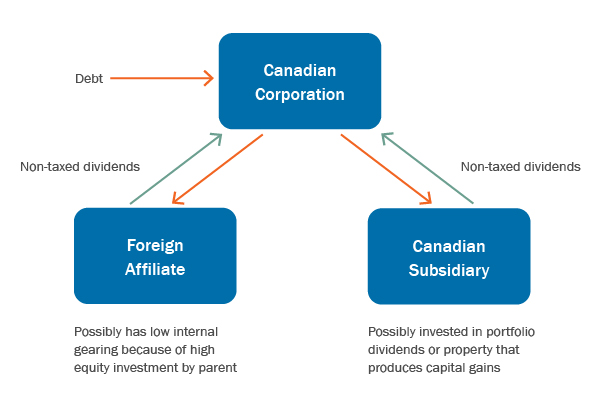

Highlights Of Draft Tax Legislation To Implement Certain Budget 2021 Measures Insights Torys Llp

Highlights Of Draft Tax Legislation To Implement Certain Budget 2021 Measures Insights Torys Llp

Pin By Vicky Wood On Genealogy Search Tips In 2022 Wake County Poll Tax Polls

Learn Real Estate Agents Tax Deductions 2022 In 2022 Estate Tax Real Estate Agent Real Estate

From Banking To Cooking Gas Price What Is Changing From Jan 2022 Are You A Bank Customer Do You Withdraw Money Often I In 2022 What Is Change Gas Prices Cook Gas

Airbnb Management Expense Spreadsheet Tracker Calculate Etsy In 2022 Rental Property Management Rental Income Spreadsheet

Taxes 2022 Important Changes To Know For This Year S Tax Season

This Is Such A Powerful Quote There S Nothing More Important Than Family Share This Post If You Agree Quoteofthe In 2022 Powerful Quotes Family Plan How To Plan

Happy 2022 Texas Has Several New Laws Coming Into Force With The New Year Do You Know What These New Laws Are Expect Changes In 2022 Texas Law Law Office Estate Tax

Tax Return In 2022 Tax Brackets Standard Deduction Estate Tax

Fiscal Cliff Infographic Small Business Association Payroll Taxes Estate Tax

Bc S Property Tax Increases What Has Been The Impact Of The 2018 Changes Policy Note